Changing Demographics: Nurturing humanity

Impacted SDGs

Key megatrends

Global population growth

Aging population

The three challenges in healthcare we are focusing on…

Variable quality of care

Large variance in cancer survival rates globally, e.g. ~8x variance for stomach cancer

Unmet patient needs

¼ of all deaths are premature – and there - 95% of rare diseases lack FDA-approved treatments

Rising healthcare costs

Costs are growing at 1-2 p.p. above GDP - 30%+ of expenditure is estimated to be waste in advanced healthcare systems

Our strategy is focused around 3 core themes that directly contribute to enable

transformative and innovative solutions to improve healthcare

1 Omics

The study of all molecules in the human biology system, covering a large family of cellular molecules - e.g. genes, proteins, or small metabolites

2 Synthetic biology

Synthetic biology is the combination of science and engineering to construct new biological entities and redesign existing ones

3 Healthcare analytics

Healthcare analytics is the use of data and statistics to enable a more efficient and higher quality healthcare

- Mass Spec tools and services

- Detection (NGS, PCR, Microarray)

- Sequencing and 3D analysis of protein structures

- Proteomics

- Genomics

- Metabolomics

- Oligo synthesis companies

- Viral vectors

- Cell and Gene Therapy

- Genetic engineering

- Artificial cells

- Tissue engineering

- Organ printing

- Personalized health journeys

- Smarter diagnostics

- Activity data from smart wearables

- Treatment adherence monitoring

- Big data analytics

- Real world evidence

Lenses

Technologies Analytical software Services

Technologie

Analytical software

Services

Each of these domains encompass a large and dynamic ecosystem with many sub-sectors and market niches. Summa screens for the most relevant investable niches within these ecosystems through deep-dive analysis of sub-sectors.

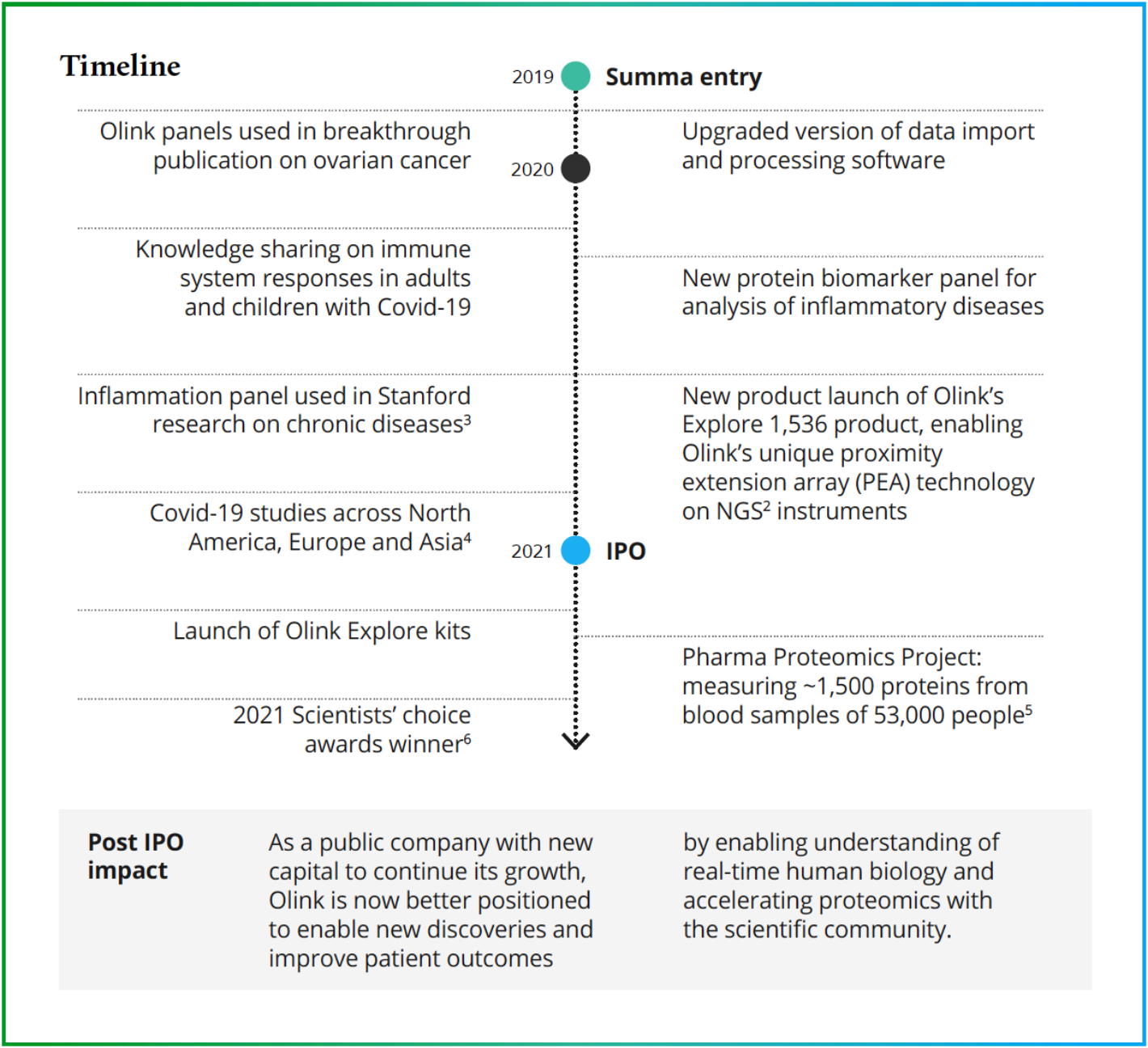

IPO exit case: Olink

Investment snapshot

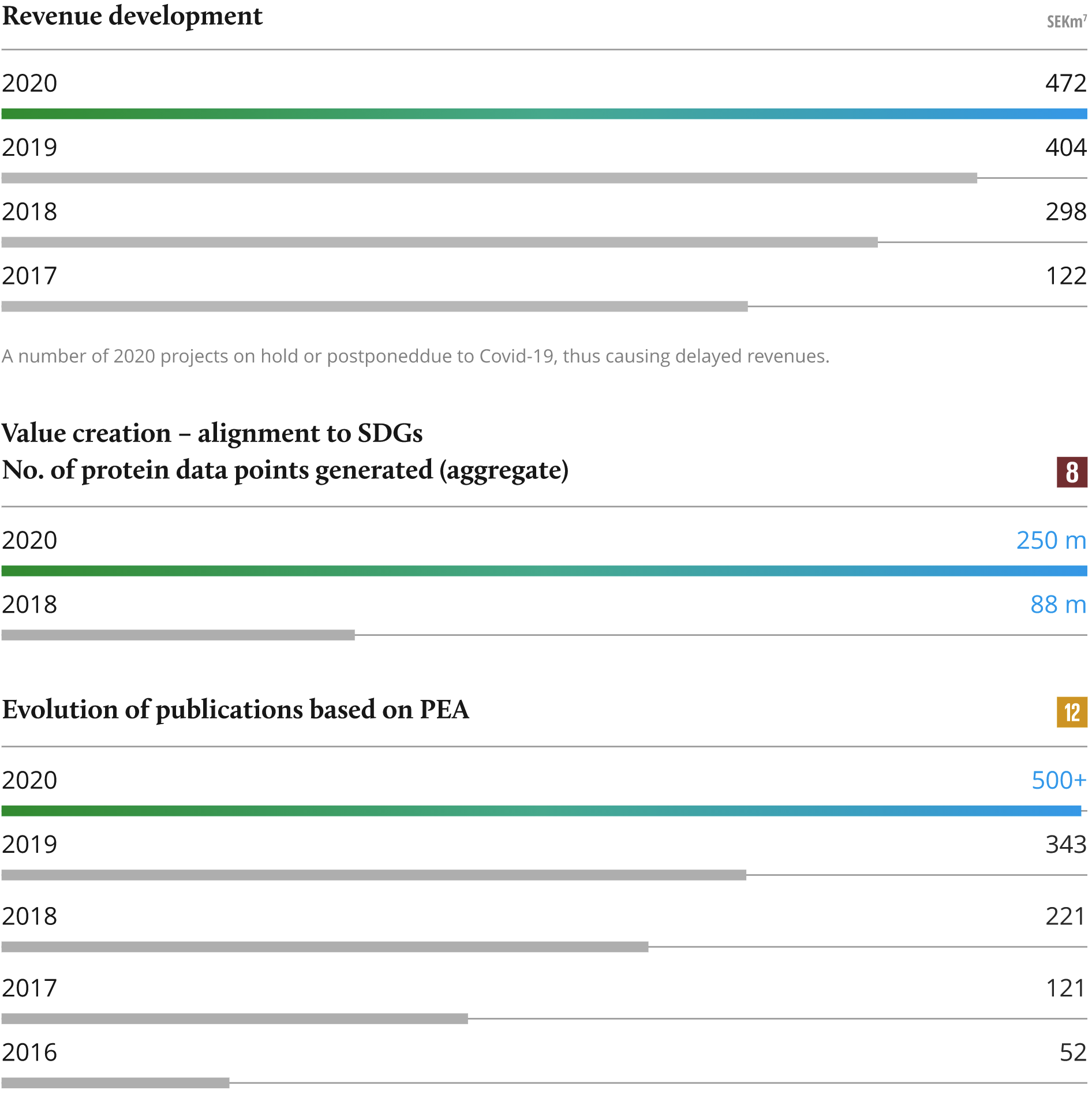

- Summa partially exited Olink in March 2021

- Total revenue base grew by 15%1 during 2020

- Expansion of product and platform offering

- Geographical expansion to Japan, China, and Singapore

SDG value creation impact

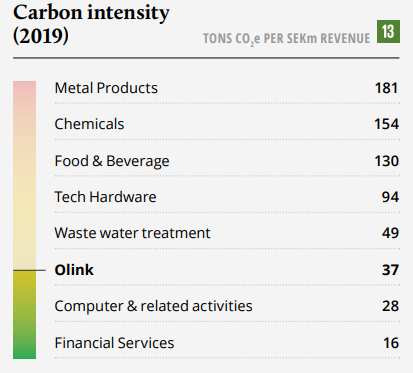

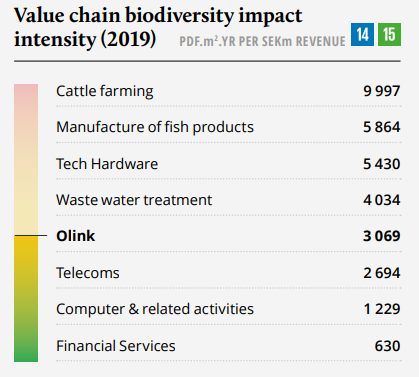

Olink’s innovative technology addresses the emerging field of proteomics, the study of proteins. Prior to our investment, Olink demonstrated clear growth opportunities, and throughout our ownership we have worked together with the management team to scale their positive impact.

Since our entry in 2019, Olink has further developed their product offering and gained a meaningful market share globally. In 2020, Olink enhanced its offering by enabling its technology on NGS2 instruments, allowing to run Olink’s protein analysis faster at a larger scale. As a result, they generated 250 million data points in 2020, compared to 88 million in 2019. The data points provide essential insights concerning human biological processes, contributing to the development of precision medicine.

Despite the disruptions caused by Covid-19, Olink accelerated their value creation impact. During 2020, they strengthened the organization with 80 new employees globally, primarily commercial, and R&D capacity, representing an increase of 60%.

- Total Constant Currency Revenue growth pro forma basis. This measure was not calculated in accordance with IFRS. Source: https://investors.olink.com/static-files/a3d85e9d-ba5a-48b0-a148-288bcec62820

- Next-Generation Sequencing (NGS): https://www.olink. com/pea-on-ngs-a-game-changer-for-proteomics/

- https://www.biorxiv.org/ content/10.1101/2020.09.30.321448v1

- https://www.olink.com/covid19/

- https://cellculturedish.com/proteogenomic-strategies-to-accelerate-drug-discovery-and-increase-success

- https://www.olink.com/selectscience-editorial-article-of-the-year-award/

- Source 2017 and 2018 from annual reports: https://bolagsverket.se/

- Value Creation Source: Olink management reporting (January 2021); Olink publication database (December 2020)

- Total Constant Currency Revenue growth pro forma basis. This measure was not calculated in accordance with IFRS. Source: https://investors.olink.com/static-files/a3d85e9d-ba5a-48b0-a148-288bcec62820

- Next-Generation Sequencing (NGS): https://www.olink. com/pea-on-ngs-a-game-changer-for-proteomics/

- https://www.biorxiv.org/ content/10.1101/2020.09.30.321448v1

- https://www.olink.com/covid19/

- https://cellculturedish.com/proteogenomic-strategies-to-accelerate-drug-discovery-and-increase-success

- https://www.olink.com/selectscience-editorial-article-of-the-year-award/

- Source 2017 and 2018 from annual reports: https://bolagsverket.se/

- Value Creation Source: Olink management reporting (January 2021); Olink publication database (December 2020)

Olink - Enabling precision medicine

SDG alignment

-

Total

57% -

Management

62% -

Board

0%

Olink at a glance

Olink develops and markets its unique technology for protein analysis in human protein biomarker research. Olink’s proprietary Proximity Extension Assay (PEA) technology enables researchers to analyze large numbers of proteins with high-throughput analysis, exceptional data quality, and minimal sample consumption. This makes research possible, which previously could not be done, at lower unit costs. The technology drives precision medicine by improving the understanding of the interaction of proteins and human disease, which is key to improving treatment and patient outcomes across many disease areas.

Key developments in 2020

In June 2020, Olink launched Explore, a new offering where its PEA technology is applied on Next-Generation Sequencing platforms, enabling greater significantly improved scale and higher throughput than ever before. This offering further strengthens Olink’s market position in high plex proteomics and enables its customers to continue making great leaps in understanding of real-time human biology.

Despite Covid-19, Olink has driven a ramp-up of the organization, increasing headcount by 60% and expect to continue its growth journey over the coming years. While Covid-19 adversely impacted the revenue growth for 2020 as customers had issues accessing their labs, Olink has continued to build a very strong pipeline and positive momentum in the market.

Impact dimensions

The challenges we face

We currently suffer from ineffective medication due to a lack of understanding of the biology of diseases. The shift from the "one size fits all" approach to precision medicine is a colossal

challenge for science. Delivering the right treatment, to the right patient at the appropriate time requires developing protein biomarker panels to improve our understanding of human biology and optimize the development of new drugs and treatments.

-

2016 estimate, World Bank. Available at: https://data.worldbank.org/indicator/SH.XPD.CHEX.GD.ZS

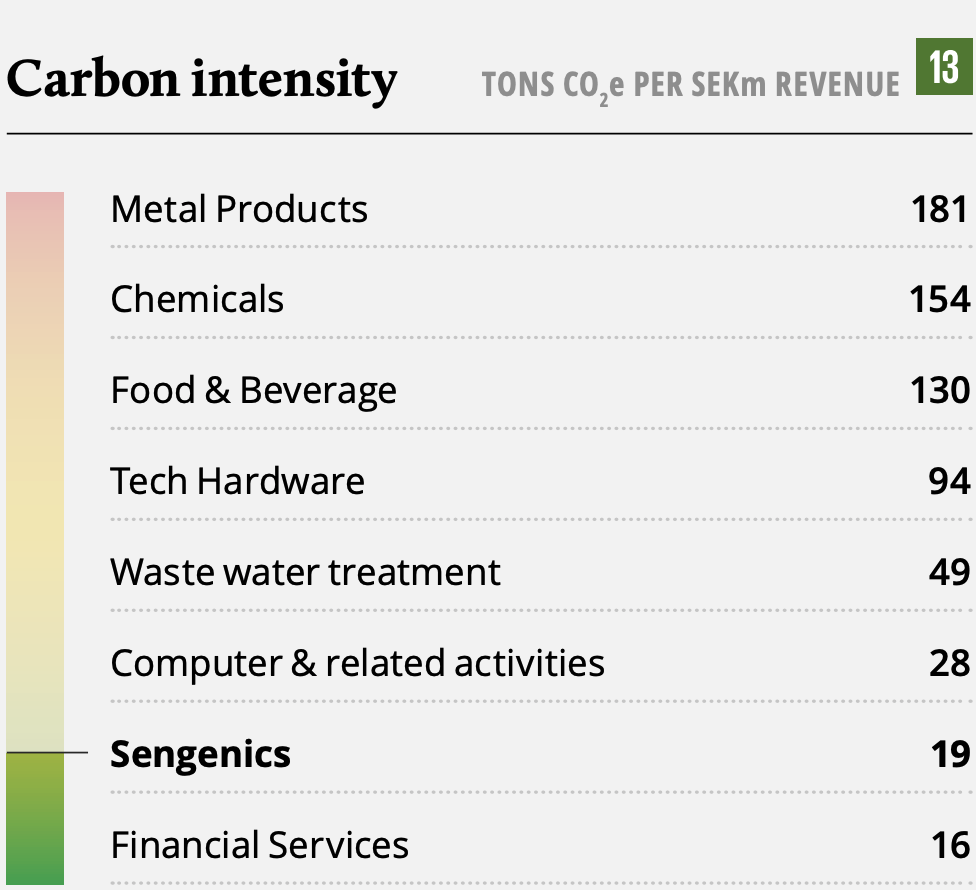

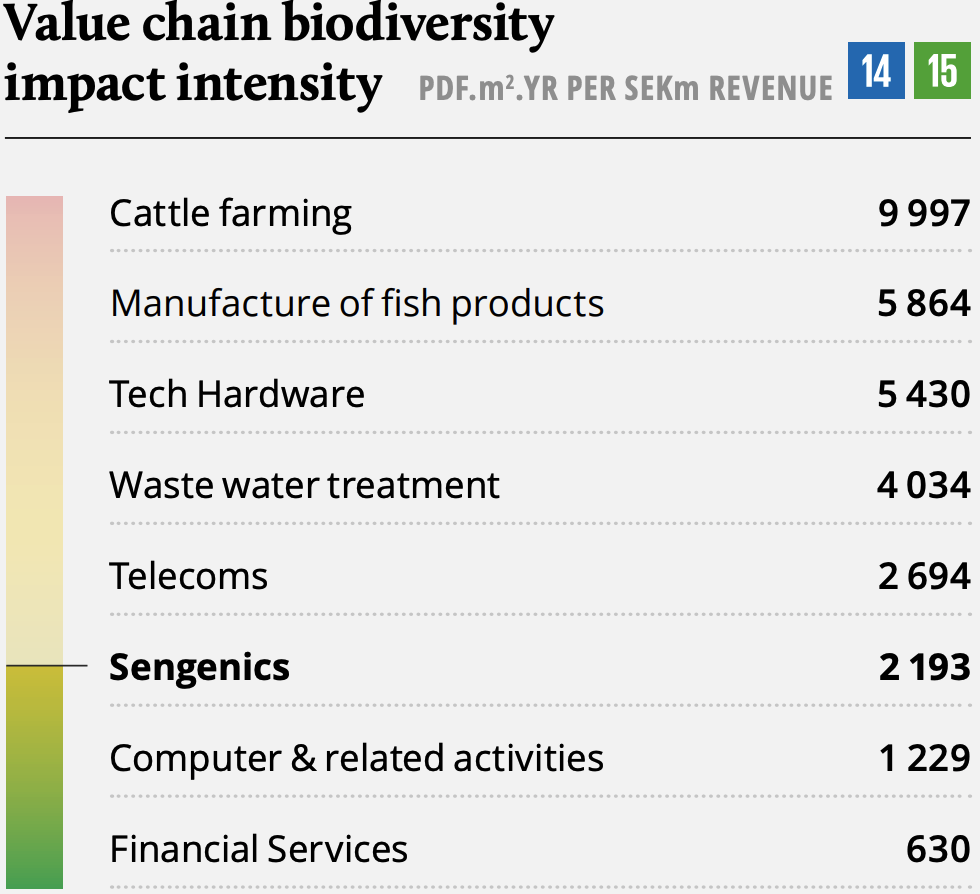

Sengenics - Enabling precision medicine

SDG alignment

-

Total

65% -

Management

55% -

Board

17%

Sengenics at a glance

Sengenics is a proteomics company with a unique technology used to produce full-length, correctly folded, and functional proteins. The technology is leveraged to support pharma and academic research to advance precision medicine through an increased understanding of the autoimmune response in humans. Sengenics’ patented KREX technology enables researchers to detect autoantibodies at high plex levels with high sensitivity. The combination of these capabilities makes KREX unique. There are a broad range of use cases for KREX in research and throughout the value chain for drug response prediction, vaccine testing, and diagnostics. Sengenics is currently focused on measurement of autoantibodies for applications in autoimmune diseases, oncology, and infectious disease. Customers include large pharma, research, and academic institutions, as well as charities and foundations engaged in funding cures for human diseases.

Key developments in 2020

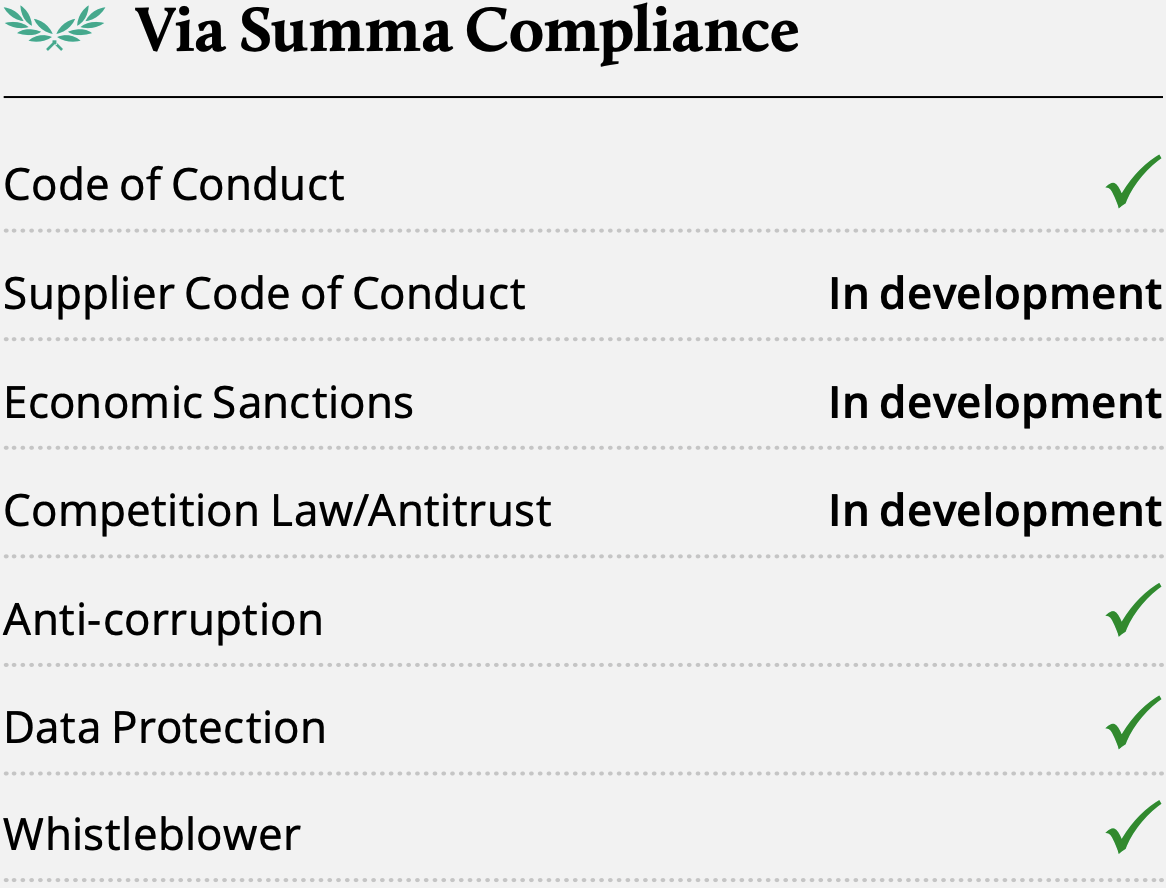

The transaction with Summa took much focus in 2020 and closed in October 2020. Covid-19 disrupted pipeline realization, with lockdowns leading to reduced customer activity and unprecedented supply chain issues in shipping and logistics. Considerable progress was made in 2020 on refining the strategy and introducing company-level as well as function-level OKRs for increased clarity and tracking. Sengenics also prepared the launch of various value creation initiatives in 2021. Several key hires were made to strengthen core functions, including a full-time CFO, Global Head of Sales and additional sales team members in the USA, Europe, and Asia. The company has also worked on preparations to set up a new R&D lab in the US during 2021. An enhanced go-to-market strategy and launch plan was developed for the new research tool services and kits initiative, which launched in Q1 2021. A new set of ESG policies and frameworks have also been implemented.

Impact dimensions

The challenges we face

We currently suffer from ineffective medication due to a lack of understanding of the biology of diseases. The shift from the "one size fits all" approach to precision medicine is a colossal challenge for science. Development of autoantibody biomarker signatures enables improved understanding of human biology and can optimize the development of safer and higher efficacy drugs, hence enabling healthcare to become more personalized and for the right treatment to be delivered to the right patient at the appropriate time.

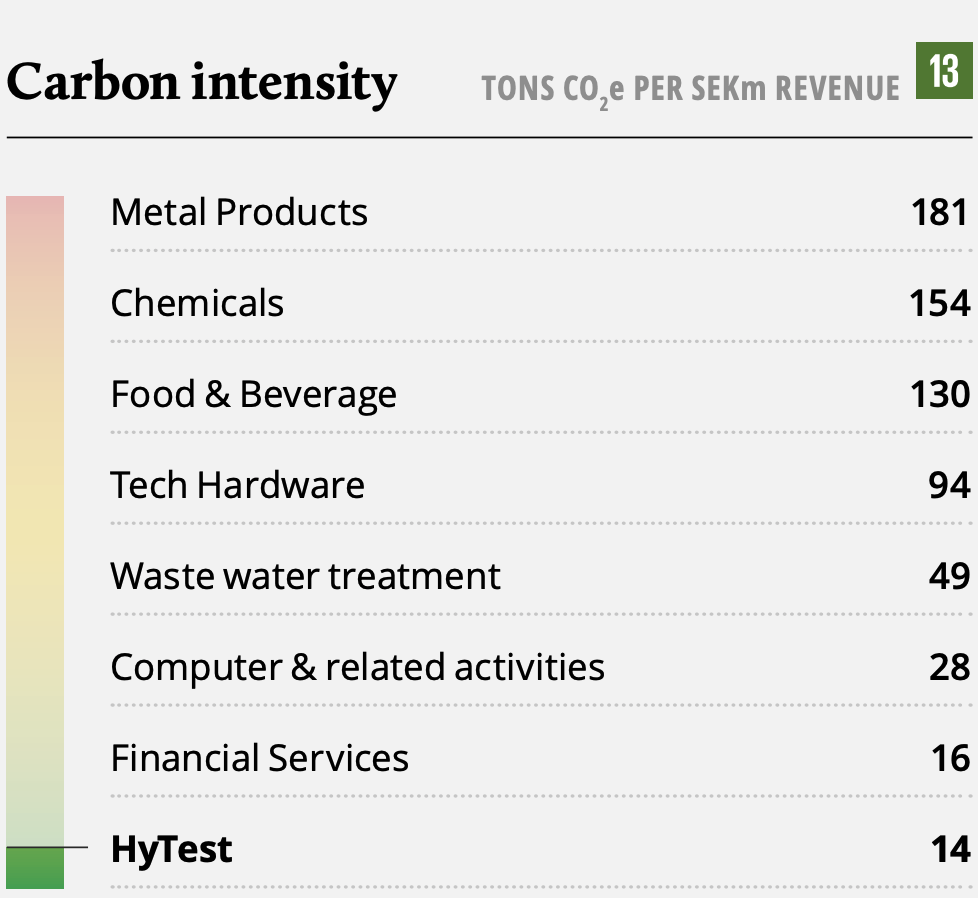

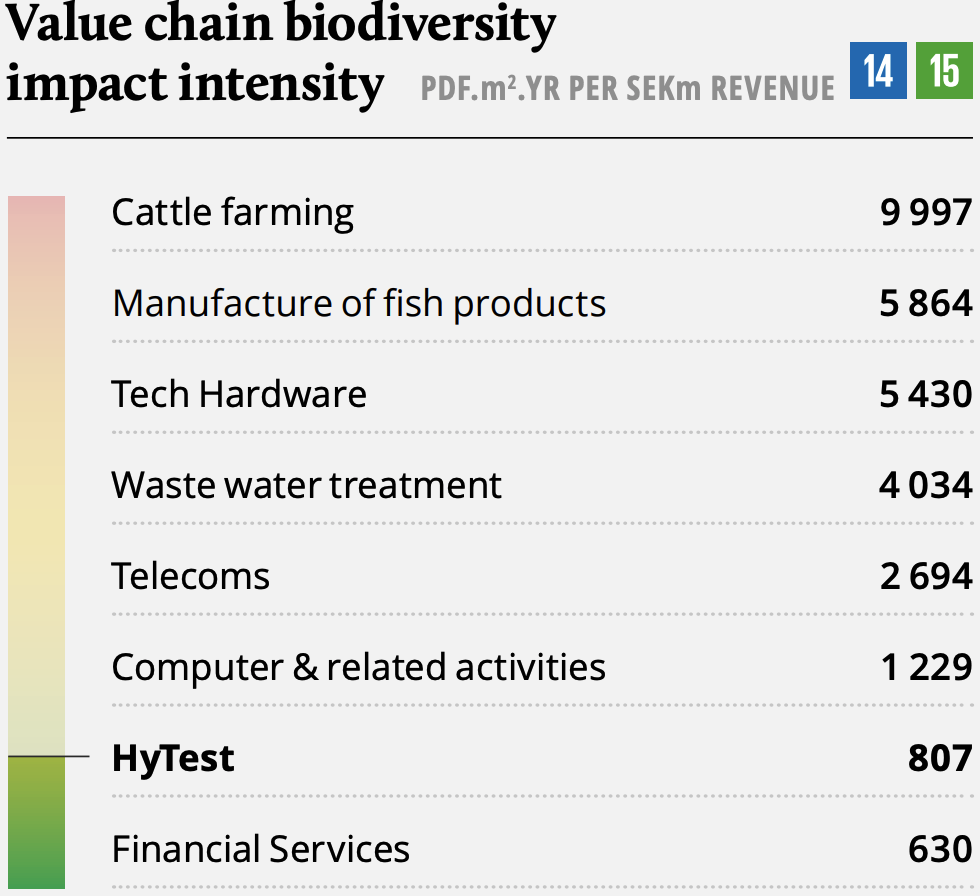

HyTest - Delivering antibodies and antigens for the IVD industry to improve patient outcomes

SDG alignment

-

Total

61% -

Management

48% -

Board

17%

HyTest at a glance

HyTest is an international company with headquarters in Finland that develops and produces antibodies and antigens for the IVD industry. The products are used as key components of various laboratory assays and kits. The company operates in a global market where growth is driven by an aging population, innovation and increasing investments in medical care. HyTest has gained a market-leading position in several key market segments, based on superior quality, strong R&D and continuous innovation.

Key developments in 2020

Covid-19 impacted HyTest's revenue growth with 2020 FY sales declining 1% yoy. Especially the Chinese diagnostics market was hit hard by the restrictions which weighed down HyTest's result, in the meanwhile the company experienced good growth in North America and Europe. Adjusted EBITDA margin was above expectations at 53%, and the company continued to generate strong cash flow. HyTest launched their first Covid-19 related monoclonal antibodies at the end of 2020, which have thus far been very well received by customers worldwide. The new product development present opportunities for significant revenue increases in 2021. HyTest continued to strengthen its organization across the regions during 2020 and Juhana Rauramo was promoted from CCO to CEO as of January 2021.

Impact dimensions

The challenges we face

An aging population, advances in research and technology, and the global trend of increased investments in medical care and wellness drive the need for high-quality antibodies and antigens, which are key components in various laboratory assays and diagnostic kits. In a world suffering from a global pandemic, testing for critical conditions has become increasingly important.

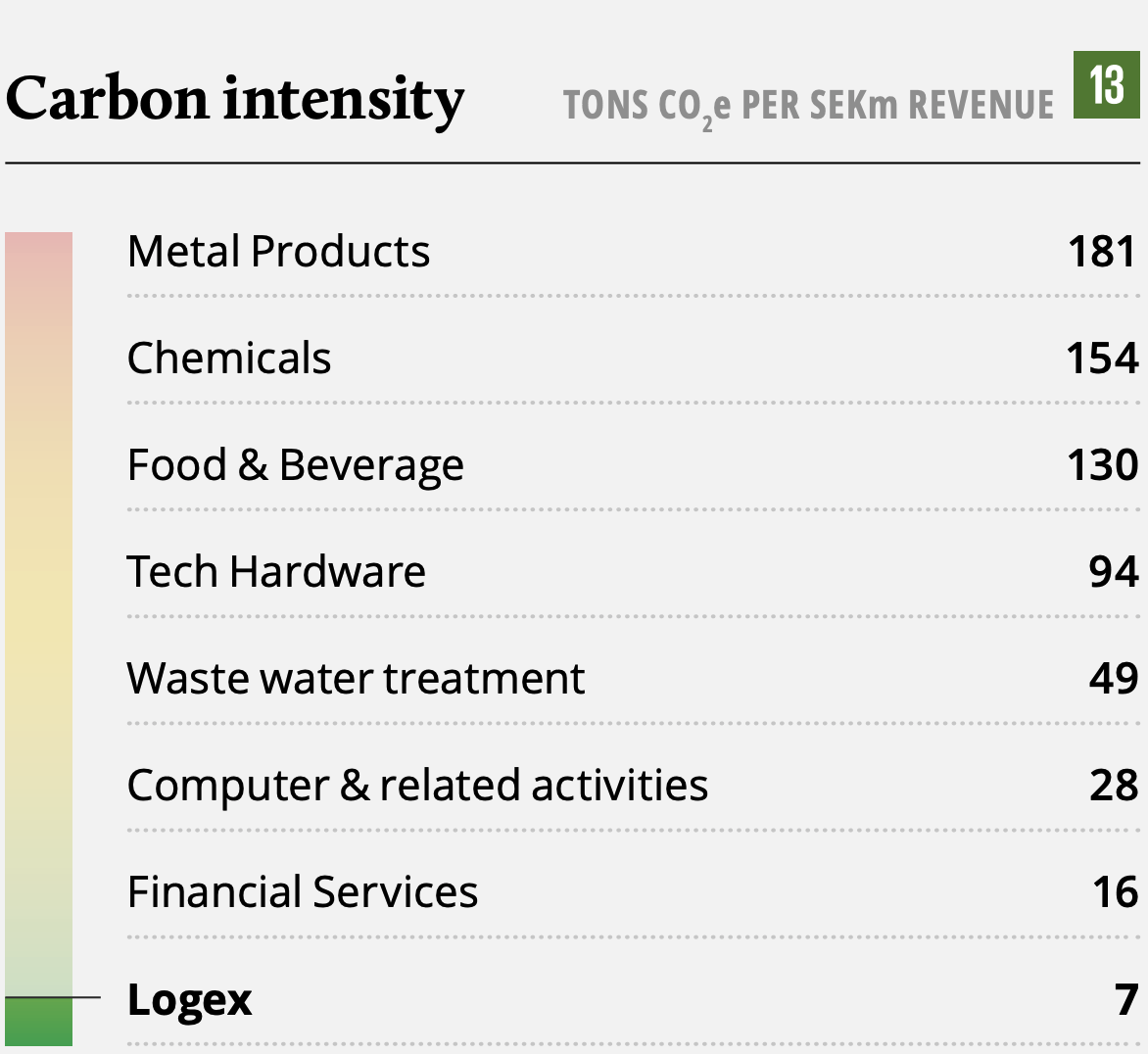

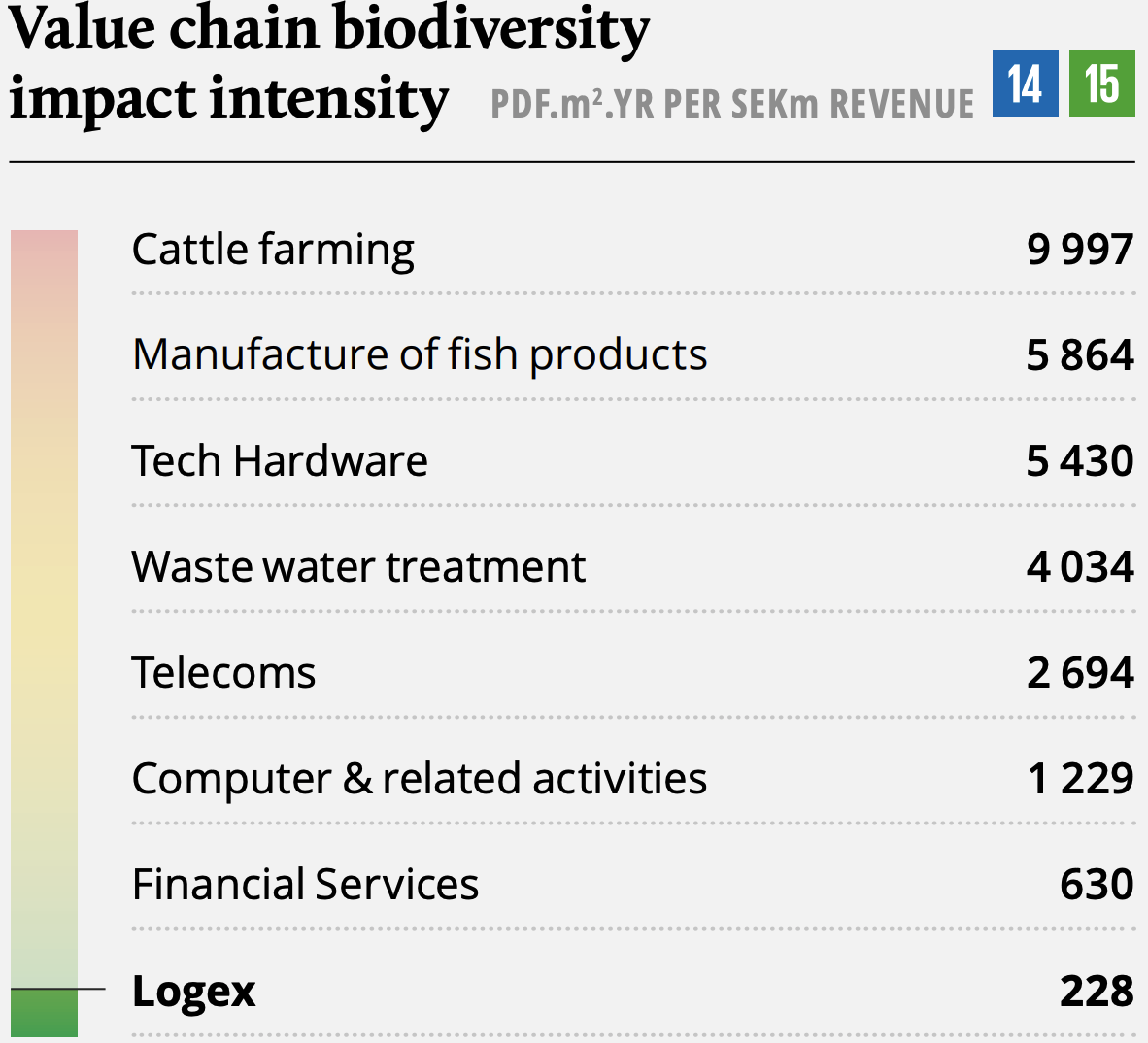

LOGEX - Turning data into better healthcare

SDG alignment

-

Total

36% -

Management

33% -

Board

0%

Logex at a glance

LOGEX is the European leader in advanced analytics for healthcare, serving providers, payors and authorities. The company has the most comprehensiveproduct portfolio in its field in Europe, and the broadest geographical reach.

The company operates three main business units:

- Financial analytics (e.g., cost, resource allocation, planning),

- Outcomes analytics (e.g., healthcare quality outcome measurement

and benchmarking) - Life sciences (real world evidence data and analytics)

Key developments in 2020

LOGEX delivered solid results in 2020 despite Covid-19 disruptions. A large integration effort has been done in 2019 and 2020, resulting in a reshaped business, organization, strategy, and product that has increased clarity on focus and priorities.

In 2020, LOGEX launched and rolled out the next generation Financial Analytics platform, a key milestone for the international growth plan. The company also progressed a key partnership with ICHOM (International Consortium for Health Outcomes Measurement), which was secured in Q1 2021.

Moreover, LOGEX strengthened its position in Financial Analytics in the Nordics through the acquisition of Analysesentret. The company also built further international presence with the partnership and a minority investment in the Spanish outcome analytics company HopesOnHealth.

Impact dimensions

The challenges we face

Healthcare systems globally are under pressure from increasing costs, whilst the need to improve quality is continuously increasing. There is a lack of transparency in both outcomes and costs in healthcare, which makes it very difficult to fully comprehend and address these challenges.

- 2018 estimate, World Bank. Available at: https://data.worldbank.org/indicator/SH.XPD.CHEX.GD.ZS

- 13x reflects increase in maternal mortality from OECD Health May 2016