Summa Equity Scorecard

SDG Alignment

-

All employees

36% -

Management

33% -

Board

75%

- Not weighted by ownership share, certain minority investments excluded

- Excl. certain minority investments. 100% of Summa's AUM, and each individual investment, is SDG aligned according to our standard for sourcing, due-diligence and stewardship

- Full AUM including co-invests

- Implementation status is as of Q2 2021. Simple average, not weighted by the value of each investment. Olink excluded due to lack of data. Investments that are within the 6 month period since Summa entry (i.e. Kiona) have been excluded. Investments representing less than 0.4% of the AUM value have been excluded. Included companies currently without adequate procedures for a policy area are either in the implementation phase, or in low-risk industries/geographies.

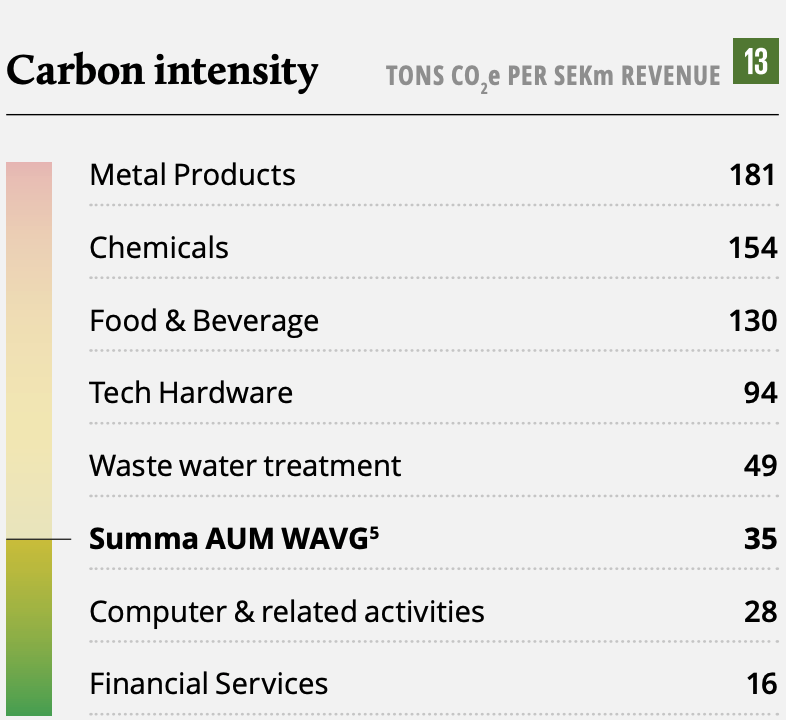

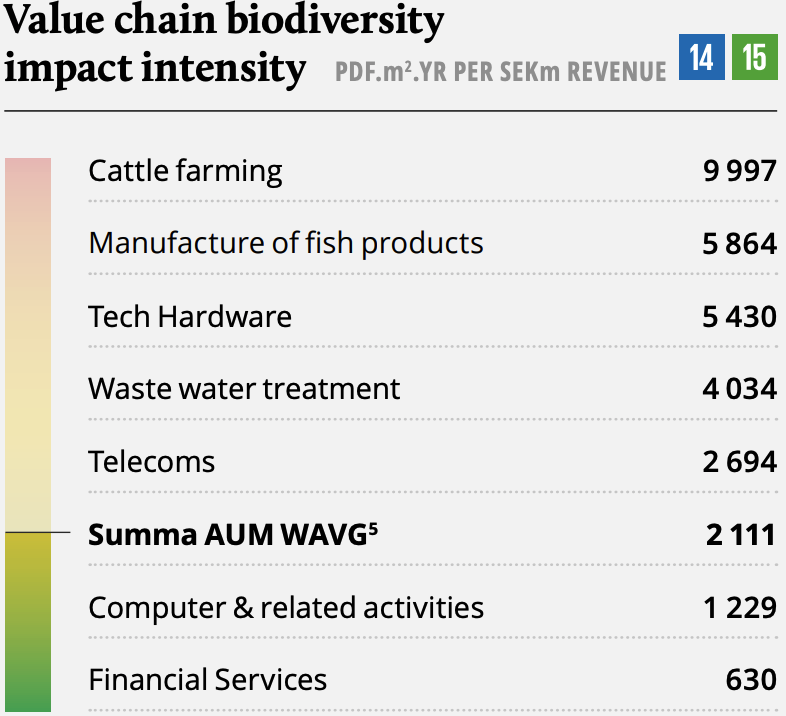

- ‘weighted average’ means a ratio of the weight of the investment by Summa in an investee company in relation to all investments of Summa; weight has been determined by using current (fair) value as of Q4 2020. Companies for which ESG data could not be obtained have been excluded (e.g. Olink)

Summa at a glance

Summa is a thematic investment firm defined by a purpose-driven team that has come together to invest in companies that address some of our global challenges.

We focus on companies in industries supported by megatrends within three themes: Resource Efficiency, Changing Demographics and Tech-Enabled Business. Our portfolio companies across the three themes have the potential for long-term sustainable outperformance as they help address material social, environmental and governance challenges that we need to solve as a society. Summa uses the Sustainable Development Goals (SDGs) as a framework to identify the challenges that we invest in.

Key developments in 2020

Throughout 2020, Summa has focused on assisting our portfolio companies in managing the Covid-19 crisis and further developing our organization and processes. While inducting a new company into our portfolio, Sengenics, we have also helped our investees complete many add-ons during the year.

We have also significantly strengthened our data gathering procedures in preparation for SFDR and finalized Via Summa Compliance to enhance good governance. Lastly, we are in the process to become a certified B Corporation which will further strengthen our ESG alignment.

- Not weighted by ownership share, certain minority investments excluded

- Excl. certain minority investments. 100% of Summa's AUM, and each individual investment, is SDG aligned according to our standard for sourcing, due-diligence and stewardship

- Full AUM including co-invests

- Implementation status is as of Q2 2021. Simple average, not weighted by the value of each investment. Olink excluded due to lack of data. Investments that are within the 6 month period since Summa entry (i.e. Kiona) have been excluded. Investments representing less than 0.4% of the AUM value have been excluded. Included companies currently without adequate procedures for a policy area are either in the implementation phase, or in low-risk industries/geographies.

- ‘weighted average’ means a ratio of the weight of the investment by Summa in an investee company in relation to all investments of Summa; weight has been determined by using current (fair) value as of Q4 2020. Companies for which ESG data could not be obtained have been excluded (e.g. Olink)

Letter from the Managing Partner

It is great to release our portfolio report at such a positive time for us as a business, having just completed several exits. Vaccinations are accelerating around the globe and we hope to see a gradual easing of restrictions that allow our business and daily lives to return to normal.

It is great to release our portfolio report at such a positive time for us as a business, having just completed several exits. Vaccinations are accelerating around the globe and we hope to see a gradual easing of restrictions that allow our business and daily lives to return to normal.

Covid-19 has affected everyone in some way, and throughout the past 12 months our primary concern has been the health and wellbeing of our team and the employees in our portfolio companies. Disruptions in the supply chain, employee health, and restrictions are some examples of challenges that our colleagues and partners have helped us overcome. We are impressed by the resilience, spirit, and determination they have shown in the face of such challenging and unpredictable conditions!

Black swans have become white swans

The pandemic has caused Summa’s thesis to be truly tested for the first time and it passed with flying colors. Summa Fund I and Fund II achieved a combined 95% increase in value from 2019 to 2020, with a positive value driver contribution across all three investment themes. The last year has helped to demonstrate that investing in companies that are solving the world’s biggest challenges is the only future-proof way to achieve sustainable growth and avoid turbulence in an increasingly uncertain world. These companies are not only resilient in times of trouble, but they significantly outperform.

We must accept that, just as Covid-19 was not improbable, these highly disruptive events are no longer improbable; they are the natural consequence of the megatrends that are underway. Black swans have become white swans, and governments, businesses and investors must adapt, by tackling these externalities head on.

We believe Private Equity 4.0 is a truly future-proof strategy

At Summa we have been aware of this shift for some time, and the challenges of the last 12 months have only served to galvanize the team, highlighting the sheer importance of our Private Equity (PE) 4.0 strategy. More than ever, we are convinced that becoming more sustainable is the only way to build more resilient businesses and deliver outsized returns.

Our mission was given further momentum through our inclusion, along with our portfolio company Norsk Gjenvinning, in Rebecca Henderson’s award-nominated book “Reimagining Capitalism”. We were also proud to be named the Continental Regional Private Equity House of the Year at the Real Deals Private Equity Awards 2020, and more recently Best ESG Initiatives and Best Nordic LBO Fund at the Private Equity Exchange Awards 2020.

This year, we have also started to report impact-weighted accounts. The results from our first pilot show a net positive in terms of environmental externalities. Our portfolio could add up to 7 percentage points in profit margin, if they could internalize this value. That is being future-proof.

Covid-19 has been a wake-up call for the world, learning the hard way that externalities matter. I am hopeful that we are now at a turning point, moving from destroying our planet to restoring it. We have over the past five years tried to show and prove that externalities are not anomalies, they are proof that our system is not working. Covid-19 will be with us throughout this year, and beyond, just like climate risk is here to stay. In an increasingly volatile world, investing to solve our challenges is the best investment strategy.

Sincerely,

Awards

The Private Equity Exchange & Awards 2020

Summa has been honored by the Private Equity Exchange Awards for the second year in a row, winning both Best ESG Private Equity Initiatives and Best Nordic LBO Fund.

The awards, part of the Private Equity Exchange conference, are among the most prestigious in the calendar, with winners decided by more than 80 highprofile experts including limited partners from across the world.

Private Equity Awards 2020

We’re pleased to announce that Summa was named the Continental Regional Private Equity House of the Year at the Real Deals Private Equity Awards 2020.

The award recognizes the overall achievement of buyout houses focused on a particular region of the Continental market in the calendar year of 2019, reflecting success in fundraising, new deals, and exits, as well as the overall evolution of the firm.

Via Summa providing resilience in the time of Covid-19

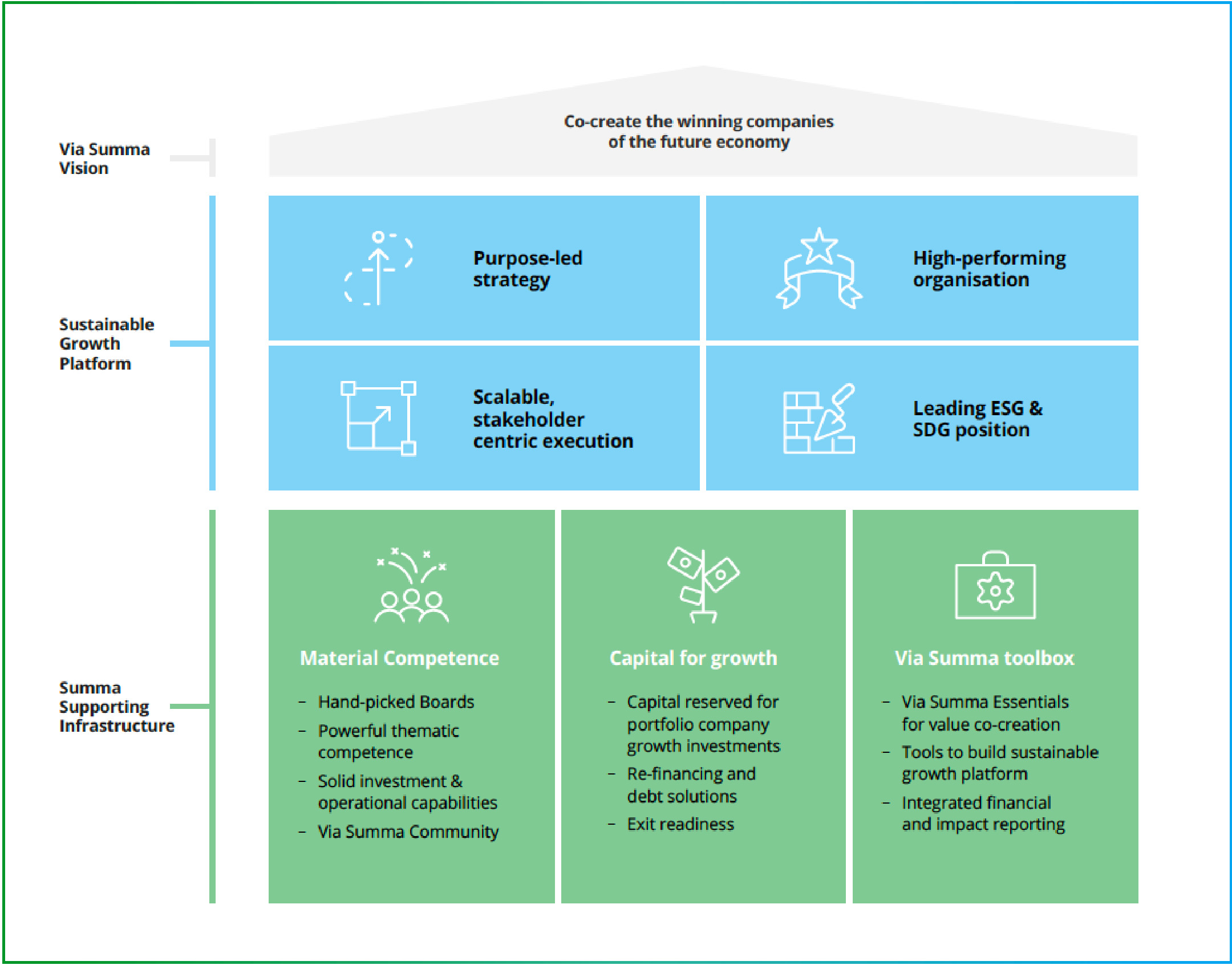

Via Summa is built around four pillars that we believe are important elements of a solid platform for sustainable growth, during Summa’s ownership horizon and beyond.

During a year of a global pandemic, certain elements of Via Summa have been leveraged by our companies to a larger extent, including the need for a more digital sales approach, agile strategy process and resilient financing solutions.

support digital transition of sales with

+80% NPS score

Summa Solution Room to help

navigate the impact of Covid-19

financing solutions to support growth

or manage Covid-19 challenges